According to the Center for Economics and Business Research, inflation coupled with rising taxes is the outlook for the UK, with energy prices hitting households’ disposable income by £315 a year.

According to new research, Brits face paying more than £300 more for spiraling energy bills next year, with poorer families set to be hit hardest.

The outlook is gloomy, with the Bank of England warning of inflation rising to a decade high of around 4 percent coupled with rising tax levels by the government.

The Centre for Economics and Business Research (CEBR) figures show consumers being put under financial pressure over the next 12 months.

The research consultancy said it is likely to see households having to pay £315 more a year or 2.5 percent off the average disposable income for a family.

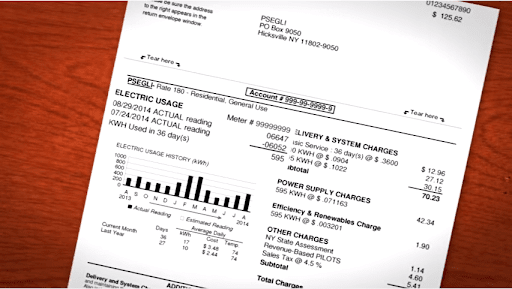

The figures are worked out with the regulator Ofgem setting out a 12 percent rise in the energy cap next month for 15 million standard variable customers, along with a probable 14 percent rise next April.

It will be the poorest who are hit the hardest, and the figures show they are likely to pay £258 more a year, which equates to 16 percent of disposable income. At the same time, the wealthiest 20 percent of the country will fork out more than £368, which is only 1 percent of their disposable income, Central Recorderday Telegraph reports.

The CEBR has stated that poorer households tend to be on a variable rather than fixed-rate tariffs, and so they will be affected more with price rises, it is reported.

The government has raised taxes for businesses and households as it looks to make £36 billion to spend on the NHS and social care.

On top of this, Brits face the prospect of council tax rises next April.

Sam Miley, an economist at CEBR, told the Telegraph: “It is clear that the rise in energy prices is set to impact the poorest households disproportionately, given that essential spending – such as utilities and food – makes up a more significant proportion of their income.

“Combining this price growth with some expected downward pressure on incomes – reflecting the upcoming termination of the furlough scheme, the reversal of the universal credit uplift and the hike to national insurance further adds to the pressure that the worst-off are set to face.”

George Buckley, the chief European economist of the financial services group Nomura, said the energy crisis would affect the UK’s recovery next year despite savings of £20 billion during 2020 for households in lockdown.

He said the problem is that to a large extent, the people that we’re able to save money during the pandemic will not be those who are now going to be affected by the spike in energy bills.

Financial markets are now betting on interest rate rises from the Bank of England, and there is a threat of “stagflation” with slow growth and high inflation that hit the country memorably in the 1970s.